does oklahoma have an estate or inheritance tax

In some cases however there are still taxes that can be placed on a persons estate. The federal estate tax exemption for 2018 is 56 million per person.

Do You Have To Pay Taxes On Inheritance All You Need To Know In 2022

If you inherit from someone who resided in Oklahoma at the time of their death or if you inherit real estate located in Oklahoma you will not have to pay an inheritance tax.

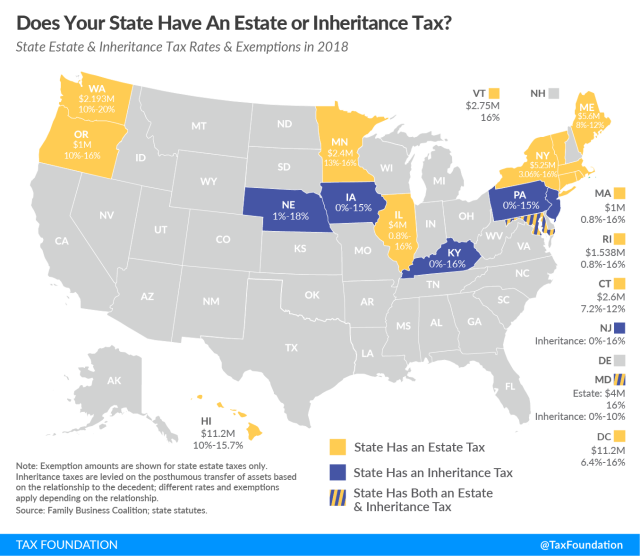

. Seven states have repealed their estate taxes since 2010. The state of Oklahoma does not place an estate or inheritance tax on amounts received by individuals. See where your state shows up on the board.

There is no estate tax in Colorado. You may think that Michigan doesnt have an inheritance tax. Oklahoma does not have an inheritance tax.

You should talk with an experienced attorney about how to protect your inheritance or. Such procedures take place in the district court. Suppose the deceased Georgia resident left their heir a 13 million worth of an estate.

The top estate tax rate is 16 percent exemption threshold. The fact that Oklahoma does not have an inheritance tax means that the states resident does not have to pay any taxes when they inherit an estate located in the state that does not exceed the lifetime exemption of 1206 million. An inheritance tax is a state-imposed tax that you pay when receiving money or property from a deceased persons estate.

Inheritance Tax Oklahoma Estate Tax Estate Planning Lawyer How To Avoid Inheritance Tax 8 Different Strategies Financebuzz State Estate And Inheritance Taxes Itep How Is Tax Liability Calculated Common Tax Questions Answered States With No Estate Tax Or Inheritance Tax Plan Where You Die Do I Need To Pay Inheritance Taxes Postic Bates P C. Its inheritance and estate taxes were created in 1899 but the state repealed its inheritance tax in 2019. Only a few states collect their own estate or inheritance tax.

While the state does not impose an inheritance or estate tax this does not mean taxes will not be assessed as a result of a death. To learn more about inheritance. The federal annual gift exclusion is now 15000.

You may still pay federal estate taxes if your estate meets the maximum established federally. In addition to having no estate tax Colorado also has no gift tax or inheritance tax. Lets cut right to the chase.

Even though Oklahoma does not require these taxes however some individuals in the state are still required to pay inheritance taxes by another state. Some states have inheritance tax some have estate tax some have both some have none at all. Hawaii and Washington State have the highest estate tax top rates in the nation at 20 percent.

As a result a couple may be able to shield up to 10 million from. Estate taxes and inheritance taxes. Upon the death of a property owner Oklahoma law provides for a legal process to take control of the deceased owners probate assets assess their value pay creditors and distribute the assets to the persons legatees if the person died with a will or heirs if the person died without a will.

If you inherit property in Oklahoma or are leaving property to a loved one within this state you should understand the inheritance tax rules in Oklahoma. The fact that Oklahoma does not have an inheritance tax means that the states resident does not have to pay any taxes when they inherit an estate located in the state that does not exceed the lifetime exemption of 1206 million. Twelve states and the District of Columbia impose estate taxes and six impose inheritance taxes.

Only a few states collect their own estate or inheritance tax. As of 2019 if a person who dies leaves behind an estate that exceeds 114 million. And remember we do not have an Oklahoma estate tax.

The fact that Oklahoma does not have an inheritance tax means that the states resident does not have to pay any taxes when they inherit an estate located in the state that does not exceed the lifetime exemption of 1206 million. The state of Colorado for example does not levy its own estate tax. The states with no state estate tax as of January 1 2020 are Alabama Alaska Arizona Arkansas California Colorado Delaware Florida Georgia Idaho Indiana Iowa Kansas Kentucky Louisiana Michigan Mississippi Missouri Montana Nebraska Nevada New Hampshire New Jersey New Mexico North Carolina North Dakota Ohio Oklahoma Pennsylvania South Carolina South.

The Executor must file a federal estate tax return within 9 months and pay 40 percent of any assets over that threshold. Florida a tax-efficient state does not have an inheritance tax. No Georgia does not have an estate tax or an inheritance tax on its inheritance laws.

Iowa Kentucky Nebraska New Jersey and Pennsylvania are the states that do have the local inheritance tax. Find out if Oklahoma collects either or both taxes on the estate after someone has died. Maryland is the only state to impose both now that New Jersey has repealed its estate tax.

Generally the state of Florida is considered one of the most tax-efficient in the United States making it a haven for many business owners. What is meant by probating an estate. Once you have paid off your car loan your Oklahoma lender has 7.

Washington has been at the top for a while but Hawaii raised. There is no inheritance tax Oklahoma. Colorado does not have an inheritance tax or estate tax.

Pin On Tax Tips However Michigans inheritance tax still applies to beneficiaries who inherited property from an individual who died on September 30 1993 or earlier. No Georgia does not have an inheritance tax. You might inherit 100000 but you would pay an inheritance tax on only.

Iowa for instance doesnt impose an inheritance tax on beneficiaries of estates valued at 25000 or less.

State Estate And Inheritance Taxes Itep

What Is Inheritance Tax Probate Advance

Iowa Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Do I Need To Pay Inheritance Taxes Postic Bates P C

Estate And Inheritance Tax State By State Housing Gurus

A New Tax Study Should Freak Out Billionaires

Spanish Supreme Court Ends Overt Discrimination Against Non Eu Eea Tax Residents Subject To Spanish Inheritance Gift Tax

Inheritance Tax How It Works How Much It Is Bankrate

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Will You Ever Need To Pay An Inheritance Tax In Oklahoma Oklahoma Estate Planning Attorneys

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Here S Which States Collect Zero Estate Or Inheritance Taxes

Inheritance Tax Here S Who Pays And In Which States Bankrate

Do I Need To Pay Inheritance Taxes Postic Bates P C

Oklahoma Estate Tax Everything You Need To Know Smartasset

Oklahoma Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die